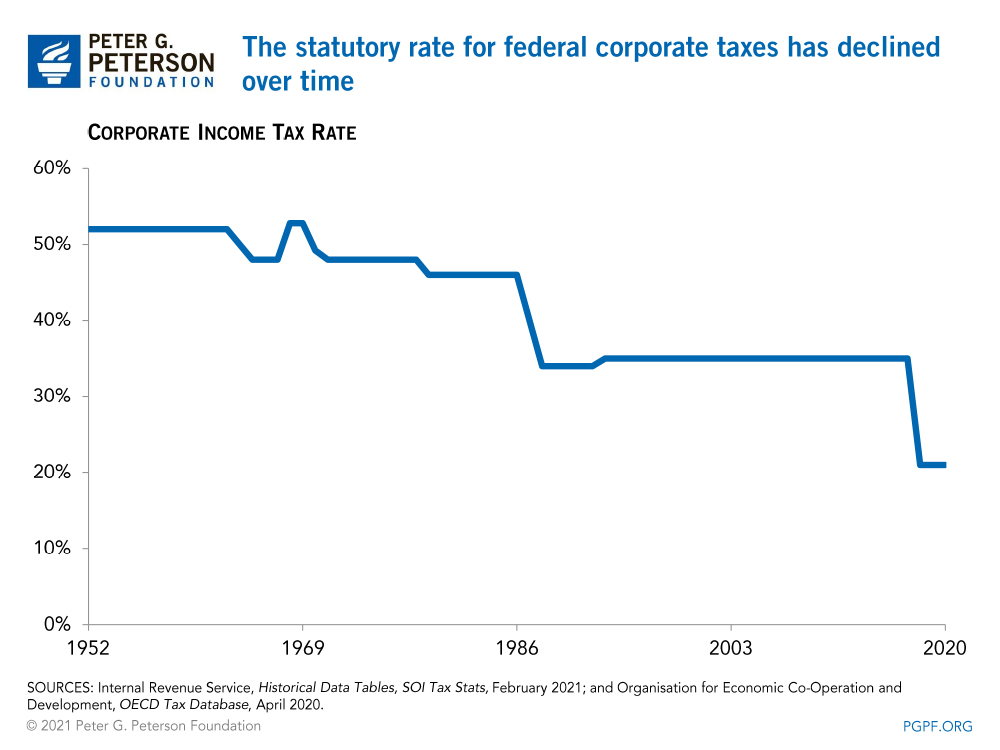

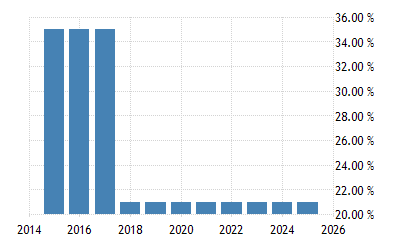

The Corporate Tax Myth. The only part of the 2018 tax cuts that… | by Avi Deutsch | Vodia Capital | Medium

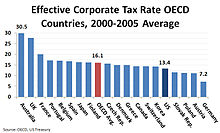

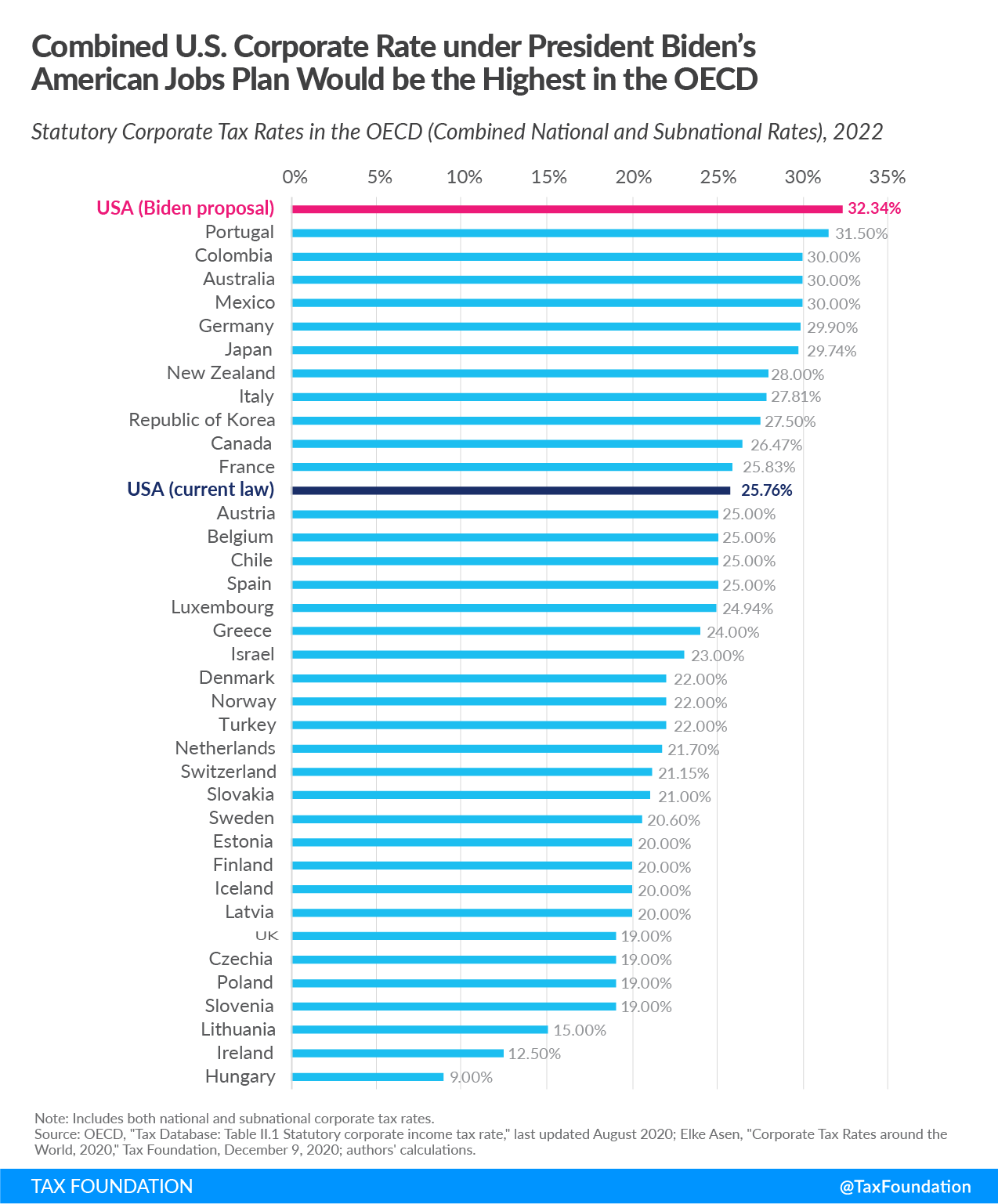

How do US corporate income tax rates and revenues compare with other countries'? | Tax Policy Center

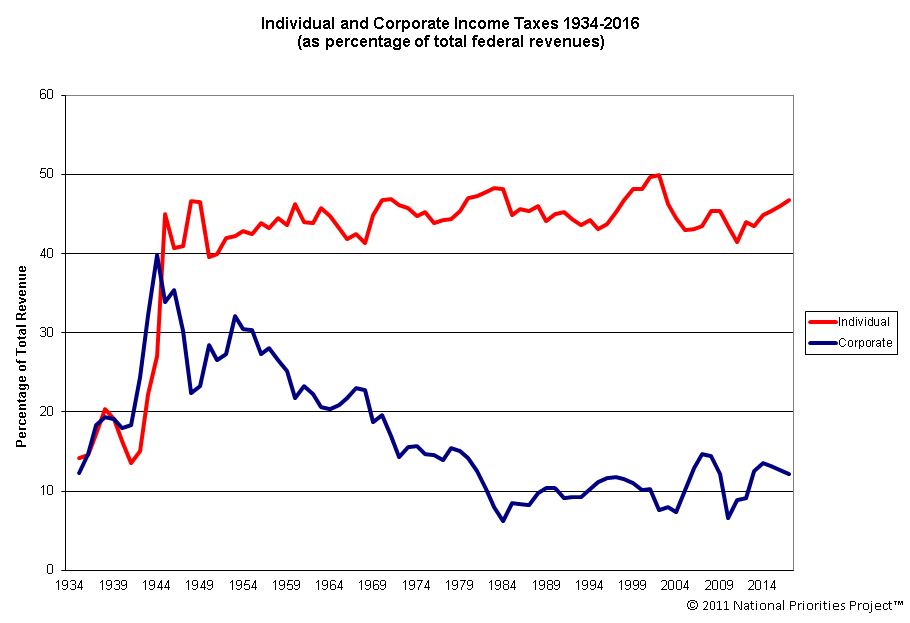

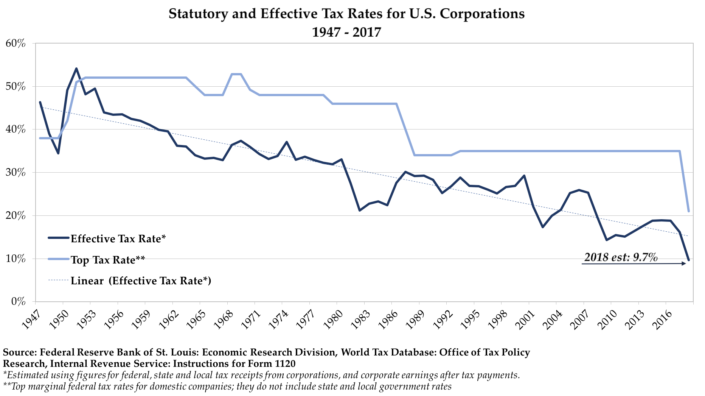

Taxes on Corporate Profits – Low, Falling for Decades, And Now Close to a Voluntary Tax | An Economic Sense

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)